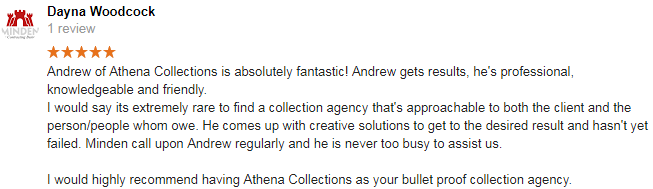

What our clients say

Call Athena Collections for Debt Collection in Liverpool

For Debt Collection Services Liverpool call Athena Collections on 0203 865 9319 or use our simple online contact form. Our experienced Debt Recovery Team can assist you with any Liverpool Commercial Debt issues, so please do not hesitate to contact our team on 0203 865 9319.

The Services we provide as B2B Debt Collection in Liverpool

We understand that with a busy work schedule debt recovery may not be at the top of your list of important things to do. Because unpaid debt can have a potential knock-on effect to cash flow it is important to address the issue, however, most companies lack the time and personnel to proactively follow up on late payers. That is where our company comes in handy. We are proud to be an extension of your business and recover the debts of your company. That way we will help you save a lot of valuable time and money in the process.

We understand that with a busy work schedule debt recovery may not be at the top of your list of important things to do. Because unpaid debt can have a potential knock-on effect to cash flow it is important to address the issue, however, most companies lack the time and personnel to proactively follow up on late payers. That is where our company comes in handy. We are proud to be an extension of your business and recover the debts of your company. That way we will help you save a lot of valuable time and money in the process.

We know the importance of client relationships to your business. That is why our professional debt recovery team strives to resolve your debt issues quickly without causing any damage to the reputation of your company.

Do you have a Question for us?

If you have accounts that have remained unpaid for a considerable period of time, our debt recovery services can seamlessly accelerate payment from reluctant payers. With our knowledge and extensive experience in the industry, all your cash flow problems are going to become a thing of the past.

Trending now; debt management companies liverpool, business debt recovery services liverpool, liverpool collection services, business debt liverpool, pre-legal recovery liverpool, services

Our debt recovery services are customised to each company’s requirements; therefore, we can give you the options and together we develop a plan on how to approach the debtors.

We are able to manage your accounts receivable functions as a one-off project, partially or fully. We can discuss and come to an agreement about how you would prefer to outsource your accounts receivable process. Our low commission rates are only charged on monies recovered and the success rate will depend on what stage each individual account is handed over to us. In fact, the sooner you pass over the account to us, the higher the collection rate would be. Hence, the commissions would be lower. It can really be as simple as that.

Trending now; Liverpool Collection Agency, Debt Collection Liverpool, Debt Recovery Agents Liverpool, debt collection agency near me, Debt Collectors Liverpool, process server liverpool, Debt Collection Agency Liverpool, services

The pre-legal debt recovery services are developed to increase debt collections without the need to take legal action in any form; therefore, not having to instruct lawyers who will charge a fee by the hour.

Our company’s proactive approach typically provides the desired result; however, we prefer to be transparent and open regarding our debt recovery services regardless of what anyone says, this is not always the situation. Debtors may not pay for a plethora of reasons, such as insolvency, not having received the invoice, the debt being disputed, cash flow being tight, their circumstances have recently changed, and much more.

Our company’s proactive approach typically provides the desired result; however, we prefer to be transparent and open regarding our debt recovery services regardless of what anyone says, this is not always the situation. Debtors may not pay for a plethora of reasons, such as insolvency, not having received the invoice, the debt being disputed, cash flow being tight, their circumstances have recently changed, and much more.

We will let you know of the actual reason as soon as possible so that you can make an informed decision.

We have a number of options for you to choose from – all will be fully explained with their pros and cons. That way you will be 100% clear of the process ahead.

If you can give us parameters, we are prepared to work within those to collect the outstanding amounts on your behalf.

Trending now; business debt collection liverpool, business to business debt recovery liverpool, small business debt collection liverpool, business debt collection agency liverpool, b2b debt collection liverpool, services Show More