We understand that your busy work schedule does not always allow for debt recovery to take top priority. In fact, a small business may lack the required time and personnel to chase behind their late payers – which can have a devastating effect on the cash flow of the business. This is exactly why our company was established; by providing you with our debt recovery services we essentially become an extension of your business, saving you valuable personnel time and money.

We understand that your busy work schedule does not always allow for debt recovery to take top priority. In fact, a small business may lack the required time and personnel to chase behind their late payers – which can have a devastating effect on the cash flow of the business. This is exactly why our company was established; by providing you with our debt recovery services we essentially become an extension of your business, saving you valuable personnel time and money.

We also understand that maintenance of client relations is essential for companies; therefore, with out debt recovery services, we work to resolve all matters speedily and professionally without causing damage to your brand’s reputation.

If the accounts remain unpaid, our company can escalate them using the debt recovery services. By incorporating continuity and utilising the benefit of our extensive experience into your debt collection process, your cash flow problems will soon disappear.

Do you have a Question for Athena?

We can tailor our debt recovery services to your specifications. Together we will discuss the options and come to an agreement on how to pursue your outstanding debts.

We are able to manage your accounts receivable functions as a one-off project, partially or fully. Together, we can identify which part and at what stage you would like us to outsource the accounts receivable procedure. Our company’s commission rates are low based on monies recovered, as well as the stage at which the account is given to us. The sooner an unpaid account is pursued by us the higher the success rate of recovery which means our collection rate will be lower. It can really be as simple as that.

Our pre-legal debt recovery service will guarantee the maximum collections on your behalf. This would be done without the need of taking any legal action against your debtors. In fact, you won’t need the services of solicitors who may charge you by the hour.

Although our proactive approach to debt recovery usually achieves the desired results, we always aim to be open and transparent about our intentions but unfortunately, no matter what they say, this does not always happen. In some cases, debtors will refuse to pay for a number of different reasons, the most common ones being: cash flow is tight; the debt is disputed; the invoice was not received; their circumstances have changed, or they are insolvent.

We will let you know of the actual reason as soon as possible so that you can make an informed decision.

There are various options available to you at this point. We will explain the advantages and disadvantages of each one so that you will have absolute clarity regarding the process that lies ahead.

Trending now; best debt collectors france, best debt recovery companies france, top debt collection companies france, best debt collection agency france, best debt collection companies france, services near me

If you can give us parameters, we are prepared to work within those to collect the outstanding amounts on your behalf.

Here’s who we are:

Athena Collections Ltd – Company Number: 10853122

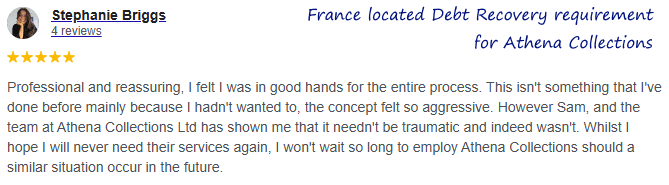

Athena Collections Ltd has over 100 five-star Google reviews. Established in 2017 and based in Dorset, our goal is to recover your owed funds quickly, alleviating cash flow strain and stress. We provide a full range of debt collection services, from early arrears to litigation and insolvency support via partnerships with solicitors and insolvency practitioners. As FCA-regulated CSA members, we collect regulated debts and follow a strict Code of Practice. Our No Collection, No Commission model charges a commission only on successfully recovered funds, covering both B2B and B2C debts.